Revenue bodies also carry out various other activities ( e.g. It is also known that across revenue bodies “audit” activities vary in their scope and intensity, and indeed in the precise nature of actions taken by officials that are deemed to constitute an “audit”. Less frequently used terms are “examinations”, “investigations”, and “enquiries”.

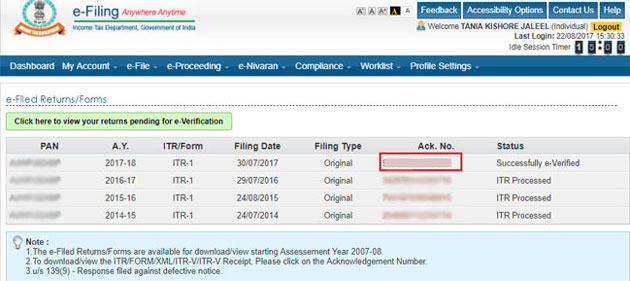

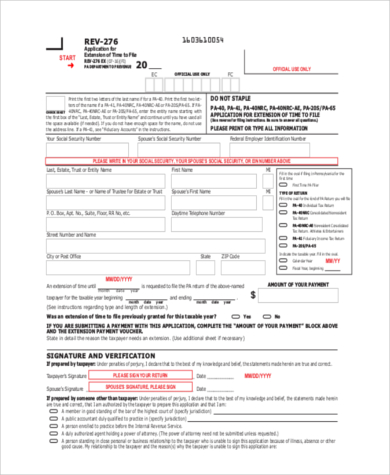

#Verification of 2016 tax extension verification

The primary verification activity undertaken by revenue bodies is usually described by the term “tax audit” (including field, desk, or correspondence audits) or “tax control”. For this reason alone, the resources used for verification activities and the contribution they make to revenue collections and rates of compliance are of considerable interest to all revenue bodies.įor the purposes of this and prior series, “verification activities” are defined as “comprising all of the activities typically undertaken by revenue bodies to check whether taxpayers have properly reported their tax liabilities in the returns filed by them”. Based on the data in Table 5.6 in Chapter 5, around 40% of surveyed revenue bodies reporting detailed information indicated that over 30% of staff resources (FTEs) are devoted to tax audit, investigation, and other verification-related activities. OPERATIONAL PERFORMANCE OF REVENUE BODIES Tax verification activitiesĪs discussed in Chapter 5, tax audit and verification activities represent a major investment of revenue body resources in surveyed countries.

Measures of relative costs of administration.Impacts of recent Government decisions on revenue bodies’ budgets.

0 kommentar(er)

0 kommentar(er)